Introduction

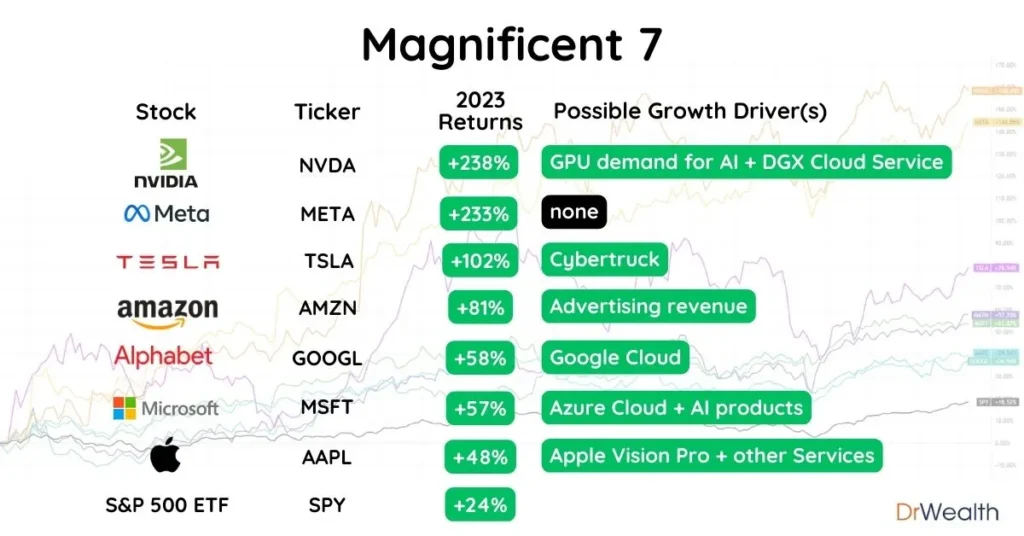

Nvidia’s GTC (GPU Technology Conference) has once again left a significant impact on the stock market, reaffirming its dominance in AI and semiconductor advancements. However, the aftermath of this highly anticipated event serves as a vital reminder for investors in the Magnificent 7 stocks—including tech giants like Apple, Microsoft, Alphabet, and Amazon—that no company, no matter how strong, is immune to market fluctuations and valuation concerns.

Nvidia’s AI Dominance and Market Reaction

Nvidia’s GTC conference showcased groundbreaking developments in AI, machine learning, and high-performance computing. The company’s innovations in AI chips and data center solutions further solidified its position as a leader in the tech sector. Despite these impressive strides, Nvidia’s stock experienced post-event volatility, reminding investors that even the most promising tech stocks face short-term sell-offs and profit-taking after major announcements.

Key takeaways from Nvidia’s GTC event:

- Introduction of next-gen AI chips aimed at revolutionizing data processing.

- Expansion of partnerships with cloud service providers like Microsoft and Amazon.

- Emphasis on generative AI, positioning Nvidia as a leader in AI-driven software and hardware solutions.

- Market response saw a mix of excitement and profit-taking, leading to stock price fluctuations.

The Lesson for Magnificent 7 Investors

The reaction to Nvidia’s event highlights an important lesson for investors in high-growth tech stocks—valuation matters. While the long-term potential of AI and semiconductor innovation remains undeniable, market sentiment plays a crucial role in stock movements.

1. Overvaluation Risks

Tech stocks, especially those in the Magnificent 7, have witnessed rapid price surges over the past year. Nvidia’s post-GTC performance underscores that even strong earnings and innovation aren’t always enough to sustain stock rallies indefinitely. Investors should be mindful of overvaluation risks and not solely rely on hype-driven price momentum.

2. The Power of Diversification

While Nvidia remains a dominant force in AI, investors should avoid overexposure to any single stock or sector. Diversification across multiple industries and assets is essential to mitigating the risks of market corrections and industry-specific downturns.

3. Market Sentiment Drives Volatility

Stock prices don’t move solely based on fundamentals—investor sentiment, institutional trading, and macroeconomic factors also play a significant role. Post-event sell-offs are common in high-growth stocks, as traders take profits or adjust positions based on valuation concerns.

What’s Next for Nvidia and AI Stocks?

Despite short-term market fluctuations, the long-term outlook for AI and semiconductor industries remains strong. Nvidia’s continued advancements in AI-driven computing, along with the increasing adoption of machine learning in various industries, provide a compelling growth trajectory for the company.

Investors should keep an eye on:

- Earnings reports to assess Nvidia’s revenue growth and profitability.

- Industry trends in AI adoption and chip development.

- Competitor movements, including advancements from AMD, Intel, and emerging AI startups.

- Macroeconomic factors, such as interest rates and government regulations impacting tech investments.

Conclusion

Nvidia’s GTC fallout serves as a critical reminder for Magnificent 7 investors—even the strongest companies face market corrections. While AI and semiconductor innovation present exciting opportunities, disciplined investing strategies, risk management, and valuation awareness are key to navigating tech sector volatility. Long-term investors should focus on fundamentals rather than short-term market reactions to stay ahead in the evolving AI landscape.